Facts & Figures

Through its member federations and associated members, EOS represents some 35,000 sawmills in 11 countries across Europe (Austria, Belgium, Denmark, Finland, France, Germany, Latvia, Norway, Romania, Sweden, Switzerland) manufacturing sawn boards, timber frames, glulam, decking, flooring, joinery, fencing and several other wood products.

Together they represent around 77% of the total European sawn wood output in a sector that has a turnover of around 35 billion EUR and employs about 250,000 people in the EU.

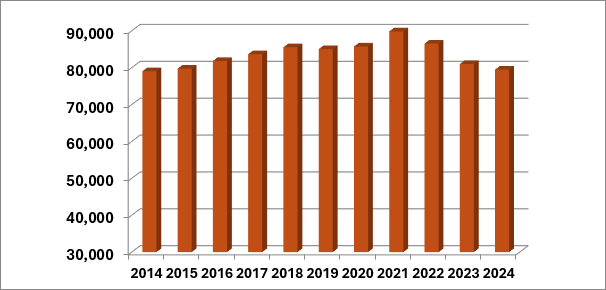

Sawn Softwood

Sawn softwood production in the member countries of EOS plus the UK has peaked in 2021. Starting from H2 2022 markets turned south and 2023 was a difficult year overall for all countries across Europe with practically no exception. Sales prices of sawnwood have generally sharply declined so, while production has shrunk by 5-10% across the EOS members, the decline in turnover has been much more sizable. Overseas the situation was equally difficult with subdued exports across the board with the exception of the United States (see Chapter 3 for more information).

Sawmills’ profitability has been dented by persistently high energy prices, in many instances high raw material prices and increasing personnel costs. Many countries have emphasized a disconnect between subdued sawnwood prices and high raw material prices. The supply of logs at affordable prices will be an issue which will dominate the markets in coming years.

Capacity increases were significant over the last couple of years and projections for 2024 indicate that this trend has stopped.

With a projected production of 22.9 million m3 in 2023 (-5.6% vs 2022) Germany remains the largest sawn softwood producer within the EOS community. Sweden ranks second with about 17.8 million m3 in 2021 (-5.7% vs 2022). Finland remains the third largest producer with 10.4 million m3 (-7.1% vs 2022), ahead of Austria with 9.1 million m3 (-9.7% vs 2022). France remains the fifth largest producer with 7 million m3 (-2.2% vs 2022).

Production is expected to decline once again in 2024 but there is hope in the industry that the market will bottom out this year.

Sawn softwood production volumes in the EOS member countries (+UK) 2014-2024 (1,000 m³) – TOTAL

Source: EOS

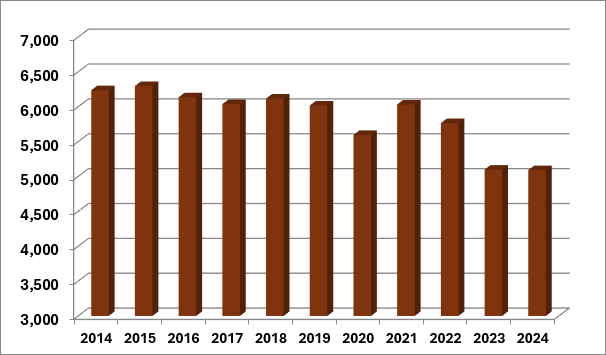

Sawn Hardwood

Production in the sawn hardwood sector has been significantly impacted by the negative economic context in 2023 with the three largest producing countries – Romania, France and Germany all reporting declines. In France the decline was smaller at just over 1% while in Germany and Romania it was significant. Overall, at EOS level a downturn of over 11% was forecasted for 2023 while production in 2024 is expected to bottom out and somewhat stabilize.

National and European legislation is curbing the availability of raw materials while many hardwood species remain underutilized. For instance, in Germany political measures to restrict forest management and beech logging, along with high roundwood exports and increased demand for firewood assortments (in Romania but also in other countries), pose problems. Raw material prices are rather high. On a brighter side, oak logs exports to China sharply declined amid the economic slowdown in the Middle Kingdom.

Hardwood companies that rely on foreign trade are negatively affected by the geopolitical situation: long-distance exports are hampered by tensions in the Middle East. MENA markets are doing somewhat better than East Asian markets but overall both in the beech and in the oak sector in 2023 a decline of about 15/20% in exports to overseas markets was observed. There is hope, however, that things will improve.

Finally, it is worth noticing that some EOS Members have reported a capacity decrease in the hardwood sector for 2023-2024.

Source: EOS

Contact

EUROPEAN ORGANISATION

OF THE SAWMILL INDUSTRY AISBL

Rue Montoyer 40

BE-1000 Brussels

Email: info@eos-oes.eu